Table of Contents

ToggleAre you a practice owner?

If so, then this article is for you.

Practice owners don’t have the opportunity to participate in a group pension plan like staff at other companies do.

Don’t be sad, though, because this article is for you: a pension plan customized to you, the owner.

Think of a group pension plan as an off-the-rack suit.

Sure, it looks great and fits OK but doesn’t quite have exactly what an Individual Pension Plan (IPP) is: a bespoke pension plan.

What is an Individual Pension Plan?

Considered the Cadillac of pension plans in Canada, an IPP is a defined benefit (DB) pension plan that allows business owners to save for retirement. The same as what teachers and goverment employees have. Dentists can have one too.

- It works like an RRSP where your investments grow tax-sheltered

- Annual contribution limits are higher than an RRSP

- Greater accumulation – up to 65% more than an RRSP by retirement

- It sets how much retirement income you will receive, which is guaranteed and payable for life

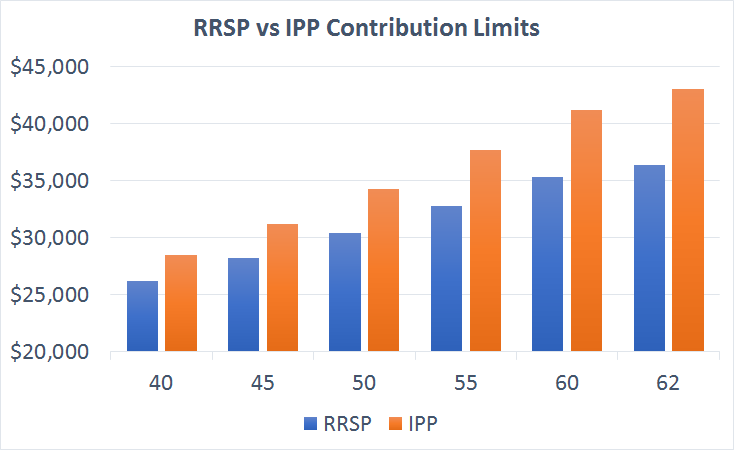

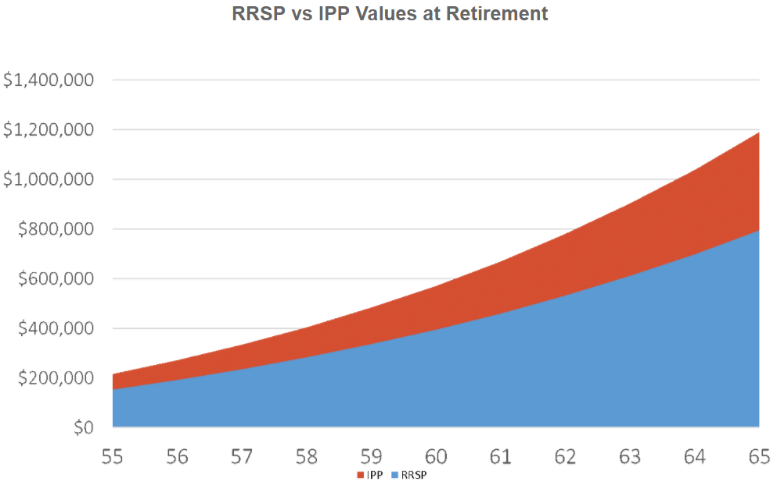

Here is an example of a Dentist earning $140,000 who started an IPP at age 40. The older you are, the more contribution room available in an IPP vs RRSP.

But why do IPPs have higher contribution limits?

Because IPPs promise a certain amount of income at retirement while RRSPs do not; the older you are, the less time there is to meet this obligation, resulting in higher contributions limits.

Example

Rob, a practice owner, decided to stop contributing to his RRSP and instead started an IPP at age 55.

By age 65, the IPP grew to $1,300,000; had he decided not to start an IPP, his RRSP would have grown to $800,000.

Rob accumulated $500,000, or 62%, more by saving inside an IPP instead of an RRSP!

Which one would you prefer to live from…$1,300,000 or $800,000?

What are the Benefits?

An IPP is one of the best tax planning tools that practice owners can leverage because it is an excellent way to save for your retirement and the contributions are large tax-deductions for your Dental Corporation.

- IPPs are 100% creditor proof

- All contributions and costs associated to the pension plan are tax-deductions for your company

- Minimum rate of return of an IPP is 7.5% per year

- If the return is less than 7.5%, your company can make additional tax-deductible contributions

Transfer Wealth to Family

IPPs are a great vehicle to transfer wealth to family members at retirement or upon death.

Just like an RRSP, upon your death, the IPP would transfer to your spouse on a tax-free, rollover basis.

If your practice continues after you retire, the family member(s) taking over the business can be added as member(s) of the IPP. Great example is son or daughter takes over from mom or dad.

By leaving the IPP open, any assets not used to provide benefits to you will remain inside the IPP and can be transferred to your children without triggering tax.

This means that upon death of you and your spouse, the remaining IPP assets can be transferred to your children, who are members of the IPP, without triggering tax.

You cannot get that with an RRSP, which triggers a tax liability to the estate upon death of the second spouse.

Are You a Good Candidate?

An IPP is specifically designed for practice owners and associates who:

- Are age 40 and over

- Practice under their own corporation

- Earn $100,000+ in T4 income (salary)

Incorporated Dentists who pay themselves dividends are not immediately eligible because dividend income does not generate RRSP contribution room, which is what you need to contribute to an IPP.

If you are not incorporated, don’t get upset because with proper tax planning, Dentists can optimize their earnings through a combination of salary and dividends so that in one year, you can start contributing to an IPP and skyrocket your retirement savings.

Learn More

With the latest tax changes that came into effect on January 1, 2018, IPPs are a great way to skyrocket your retirement savings and are not subject to the new limits to passive investment income.

To learn more about pension plans and other tax strategies like this for Dentists?

It’s time you start paying less tax and keep more of what you earn.

- Reviewsand Raises - February 20, 2022

- How To Start Opening A Dental Practice In Canada - February 16, 2022

- How Can Dental Offices Increase Profit? - February 10, 2022