Table of Contents

ToggleHow to Still Save for your Retirement in your Corporation Tax Free

What’s the most tax-efficient way to save for retirement and access those funds in your leisure years for a dentist? Many would say Registered Retirement Savings Plans or a Pension Plan.

RRSP’s are certainly an efficient way to reduce your personal taxes as contributions are deductible from your income, and they have the ability to grow your savings on a tax deferred basis, but their usefulness for business owners earning a high income is limited.

Registered plans work well for two reasons – they shelter your contributions and allow them to grow on a tax deferred basis; and when withdrawn in retirement, theoretically, you are accessing the funds in a much lower tax bracket than when you were earning the income.

However, for many of our dental clients they have been very successful, the difference in tax brackets after retirement may not be so pronounced in retirement.

We’re not suggesting that you don’t utilize RRSP’s to save for retirement or even an Individual Pension Plan (IPP). By all means, maximize your RRSP or pension contributions every year.

RRSP’s are the most popular way to save for retirement, but not the only way, especially for Dental practice owners and associates who have incorporated.

The New Tax Rules

With recent tax rules that have just been passed by our wonderful Liberal (Federal) Government, they now state that passive income over $50,000 in the corporation will start to Increase your Small Business Tax Rate (which has dropped to 13.5% in 2018 and 12.5% in 2019). This is great new but many dentists are starting to earn over $50,000 inside either DPC or a holding company due to investments or real-estate income.

Remember as long as you are a share holder of once or more corporations – this $50,000 rule applies in totality. You are associated to one or more corporation – it applies.

How to Avoid Tax Legally:

How can we avoid this tax? As mentioned in our prior blog, an Individual Pension Plan (IPP) is one great way to fund your retirement in a tax deferred environment. Another way is to consider an investment strategy that allows you to shelter 100% of your earnings growth in a vehicle where it grows tax-free.

This vehicle will create a significant cash value for your retirement and it is called a Corporate Insured Retirement Program (CIRP).

The Strategy:

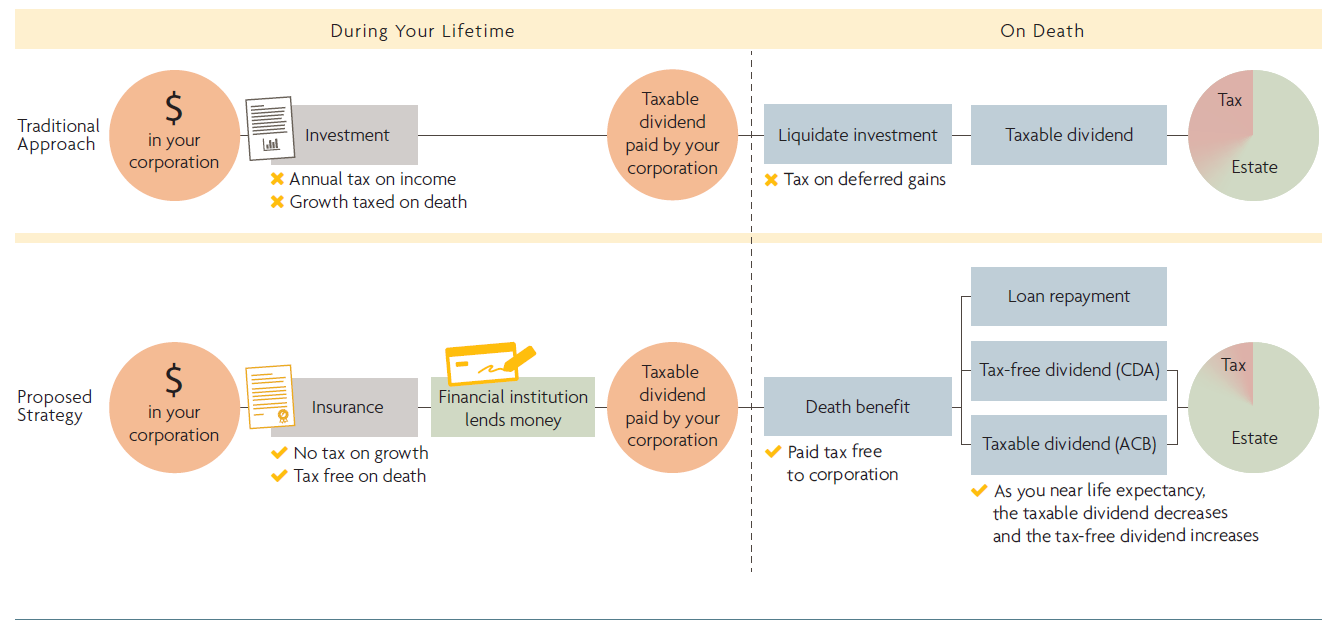

This strategy works well for dentists that have excess retained earnings in their DPC or Holding Corporation. The corporation acquires a universal life policy or whole life policy and accumulates cash value by depositing amounts to the plan in excess of what is required to fund the insurance.

Investing Excess Earnings:

The difference to do this in the corporation than personally is that soon to be 86.5 cents (2018 Tax Rates) on every dollar can fund this policy vs. personally 54 cents on the dollar at a 46% marginal tax rate.

The excess funds in the universal life or whole life contract grow tax-free to create significant cash value in the policy. At a point in the future, when the you are ready for retirement, the cash value of the corporate-owned policy can be accessed.

Ways to Borrow Against the Policy:

Corporate Borrowing:

This is where the corporation borrows the funds directly from the lender. Once the fund has been given from the lender to the corporation, the corporation can then dividend the funds as usual to a shareholder or use the funds for growth in the DPC. Both options allow for the loan to be tax deductible if there are retained earnings in the DPC to support a dividend.

Shareholder Borrowing:

The shareholder borrows funds directly from the lender. The shareholder gets consent from the DPC or Holding Company to collateralize the loan from the policy.

In order for the shareholder to attain the money tax-free vs. a taxable benefit, they have to pay the corporation a “guarantee fee” for the right to use the corporate-owned insurance policy as collateral for their personal loan.

What is this “Guarantee Fee”?

When you borrow money you usually have to give the lender some collateral. If you don’t repay the loan the lender can use your collateral to get back at least some of what you owe if not all.

Shareholders who own all or most of the shares in their DPC/Holding Company have an additional option. They can borrow personally, but will have their corporation provide the collateral.

There can be a good reason for doing this. The shareholder may not personally own any assets that they wish to collateralize. The Guarantee Fee is the differential from what the corporation can attain on interest from the loan vs. the shareholder themselves.

The shareholder then needs to pay the interest spread from the loan to the corporation. Typically, the corporation has to take these interest payments into income.

Sometimes, depending on the shareholders situation it may be the same and no “Guarantee Fee” will be needed to be paid but everything has to be documented that the shareholder can attain the same rate or CRA will deem the loan as a taxable benefit.

Which Way Is Better?

Tax consequences will vary depending on the structure selected. There is no “best” way to structure a Corporate IRP. Each structure has its benefits and each has issues to consider. The more simple way and easier to defend way with CRA is the corporate borrowing method however.

You should consult your tax advisor. Once this is done, you should be able to make an informed decision on the structure that should be implemented. Always feel free to reach out to Dental Tax if you need any assistance as well.

Real Life Client Example:

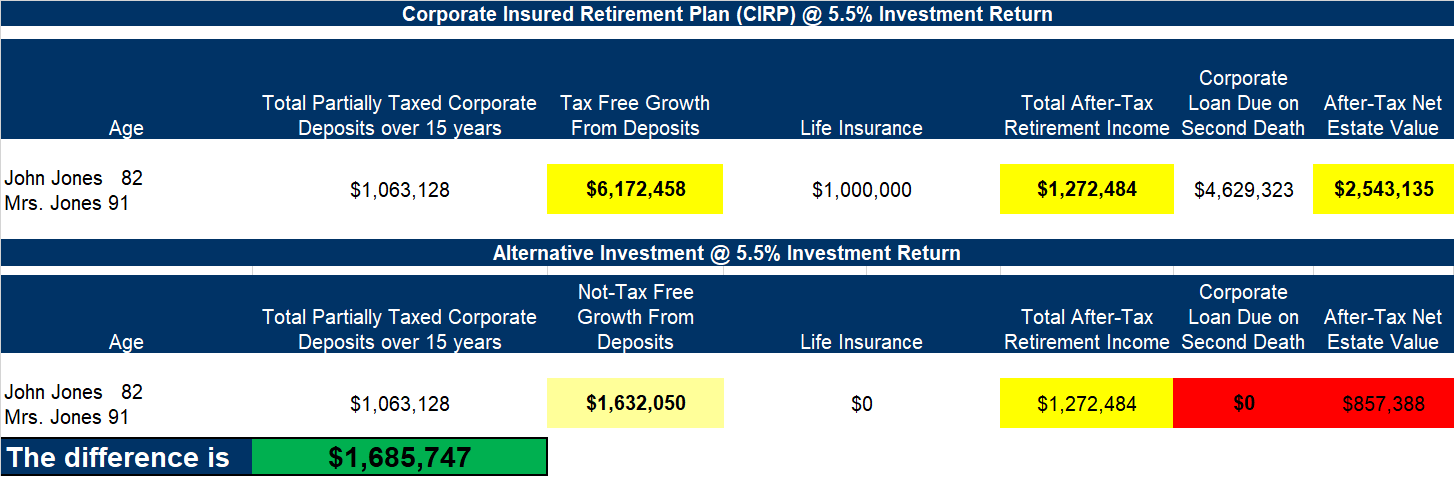

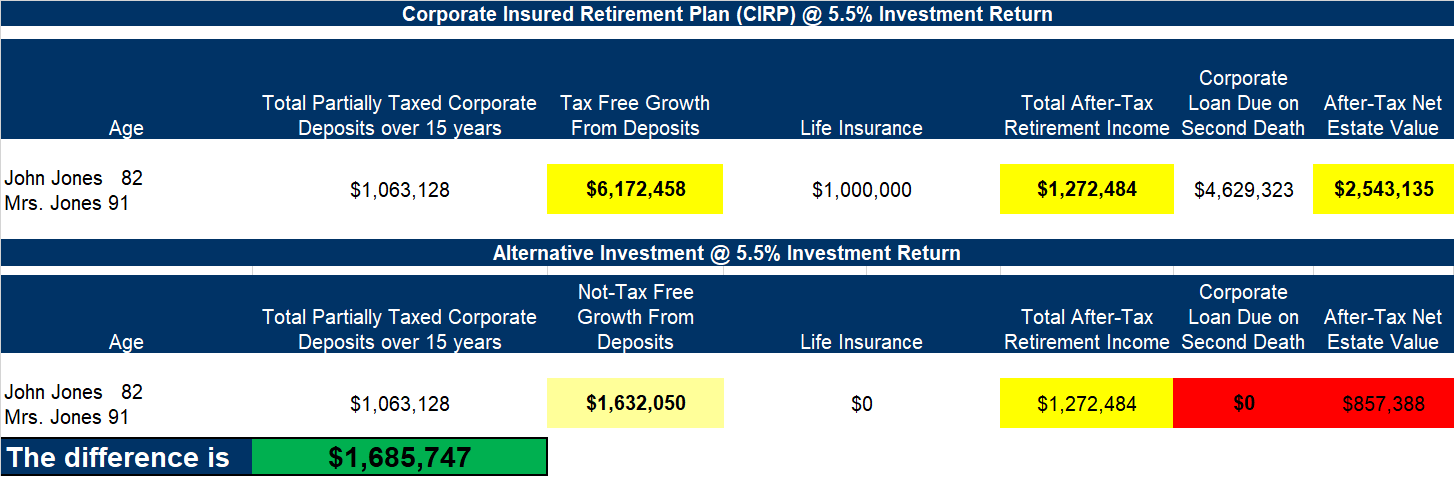

Let’s look at an example to help put things into perspective using a corporate IRP with corporate borrowing. John Jones is a 49 year-old male non-smoker dentist of average health.

John incorporated and started his practice in 2006 and is maximizing his RRSP contributions annually as well as has an Individual Pension Plan (IPP). John has excess retained earnings (cash/investments) in his corporation that he would like to use to supplement his retirement income.

John is married to Mrs. Jones who is 44, and they have three children. They realize that their vacation property and other assets will attract a fair amount of taxation upon their death, and they would like to provide funds to cover these liabilities so that portions of their estate will not have to be sold under duress.

John’s corporation acquires a $1,000,000 joint Last-to-Die universal life insurance policy on the life of his wife and himself, and deposits the maximum allowable premium into the plan annually for 15 years.

By choosing a joint last-to-die policy, John. and Mrs. Jones have guaranteed that the funds will be available upon the second death, which will trigger the estate taxes tax free through the corporation.

Example:

At life expectancy (Mrs. Jones age 91), the outstanding loan balance would be paid off by the total benefit in the life insurance policy of $2,549,135*, with the balance going to Mr. & Mrs. Jones’s corporation, then to the beneficiaries through the Capital Dividend Account – Virtually Tax Free .

Conclusion:

A corporate IRP allows for partially taxed retained earnings to fund the policy at 86.5 cents (2018) on the dollar, it lets you take advantage of tax free growth, and you can draw retirement income!

Advantages of Joint Last-to-Die Insurance Coverage

- Joint last-to-die life insurance policy ensures that the tax liabilities triggered by 2nd death are addressed without liquidating your assets.

- Take advantage of the lower cost of insurance by combining two insured lives on one policy.

- Overcome health challenges by combining one healthy life with a sub-standard life to reduce or eliminate sub-standard rates or declines.

Advantages of the Corporate Insured Retirement Program

- Investment accumulation unmatched outside of an RRSP.

- Transfers tax exposed corporate retained earnings to a tax free environment.

- Provides a tax efficient or tax-free means of accessing those funds to supplement your retirement income.

- Covers Estate Taxes at death tax free

- Helps reduce the $50,000 passive investment Income Test

The Corporate Insured Retirement Bond is one of the best ways now to save for retirement inside your Dental Professional Corporation or Holding Company. Always consult with your accountant and financial advisor to see if this opportunity is right for you or feel free to reach out to Dental Tax.

*The Example used was a true life case and all numbers used are real at the time of the case study E&OE.

- Reviewsand Raises - February 20, 2022

- How To Start Opening A Dental Practice In Canada - February 16, 2022

- How Can Dental Offices Increase Profit? - February 10, 2022