Running a dental practice isn’t just about providing excellent care to your patients – it’s also about ensuring the financial health of your business, and sometimes, that starts with the basics, even if you’ve been up and running for a while.

Accounting can seem daunting at first, especially if you’re opening a new dental office, but understanding the basics is key to managing your practice effectively. Following a basic guide can help you build a strong financial foundation.

- Professional Tax Planning

Tax obligations for dental practices include income tax, payroll tax, and GST/HST (in Canada). It’s recommended to work with a professional dental accountant to:

- Maximize deductions (e.g., equipment depreciation, staff training costs, etc.)

- Ensure compliance with tax filing deadlines

- Plan for quarterly tax payments to avoid year-end surprise

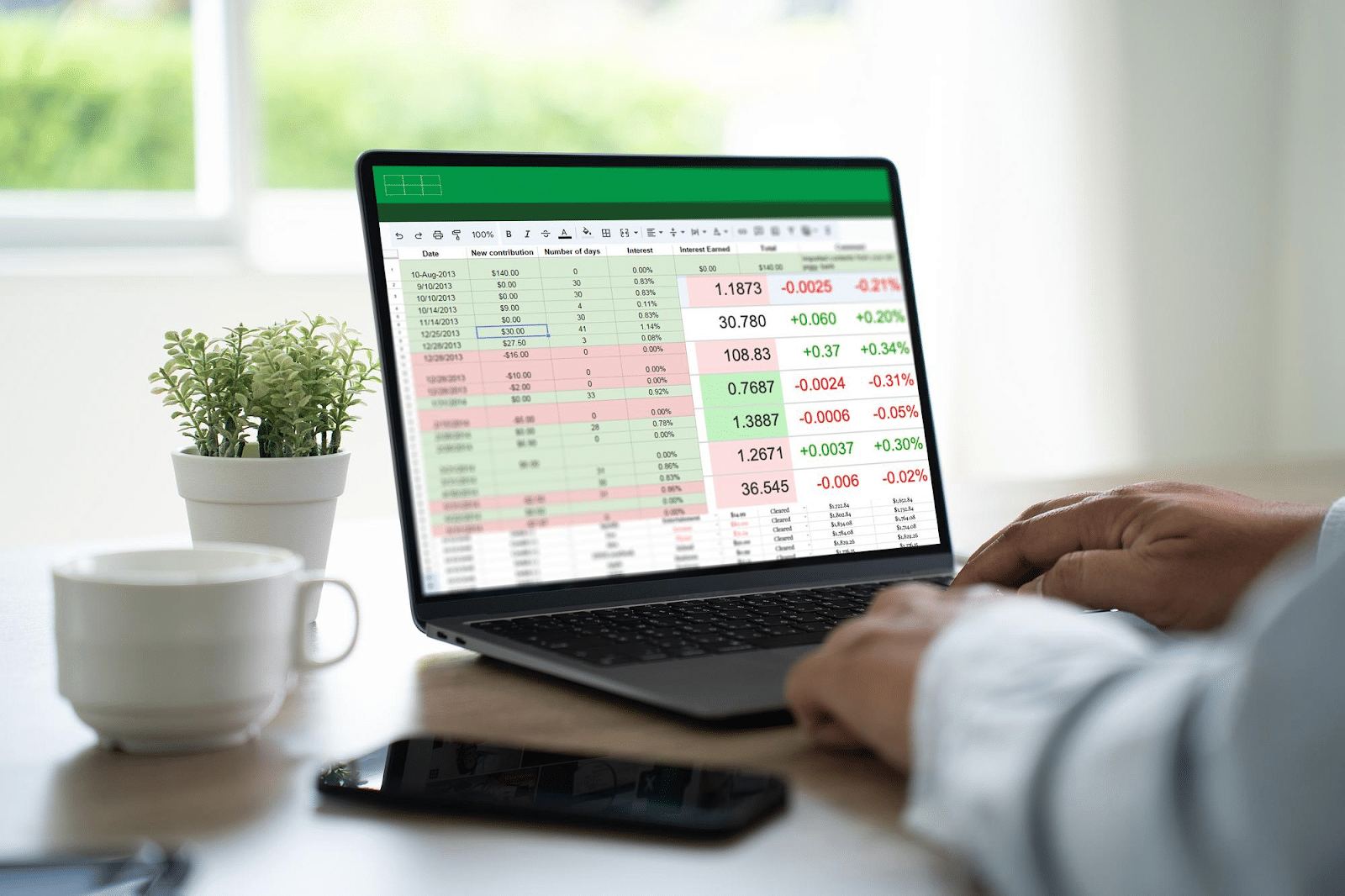

- Leverage Accounting Software

Invest in accounting software tailored to small businesses. Many solutions, like QuickBooks for example, offer features that can save time and reduce the risk of manual errors, such as:

- Automated invoicing

- Expense tracking

- Real-time reporting

- Create a Budget and Forecast

Developing a budget helps you allocate resources effectively and plan for future growth. Combine historical data with industry benchmarks to forecast things like:

- Revenue growth

- Capital expenditures (e.g., upgrading equipment or expanding facilities)

- Cash flow needs

- Set Key Performance Indicators (KPIs)

Tracking KPIs helps measure your practice’s financial health. Important KPIs for dentists may include:

- Production per hour or per chair

- Accounts receivable turnover

- Profit margins by service

- Plan for Debt Management

Many dental professionals start their careers with significant student loans or business loans for opening a practice. Develop a repayment strategy that balances reducing debt with maintaining sufficient cash flow.

- Collaborate with Professionals

A skilled accountant or financial advisor with experience in the dental industry can be invaluable. They can help you:

- Ensure regulatory compliance

- Optimize tax strategies

- Provide insights for financial decision-making

- And more

- Stay Organized

Again, it may seem obvious, but exceptional record-keeping is essential. Keep accurate and updated records of patient billing, insurance claims, and expenses. This simplifies tax preparation, supports financial audits, and overall, just makes everything easier.

Ensure the Financial Success of Your Small Dental Business

By mastering these accounting basics, you can focus more on your patients while ensuring the financial success of your practice. Prioritize ongoing education in financial management and remember that it’s okay not to do everything yourself. Work with trusted advisors and other professionals to keep your practice thriving and thoroughly organized. Utilizing accounting software can also make a huge difference in your practice’s accounting success. Ultimately, don’t let your accounting woes weigh you down. Instead, view accounting as a vital tool for understanding your business’ long-term health and success.

Adam has an MBA from the Richard Ivey School of Business in London and also holds a Chartered Investment Manager designation.

- Tax Return Preparation Guide for Dental Professionals - January 19, 2026

- Financial Lessons from Successful Dental Practices - January 12, 2026

- 2026 Tax Changes Affecting Canadian Dentists - January 5, 2026